Aetsoft STO: White

label STO platform

Launch no-code security tokens in weeks with our white label STO platform.

Highlights

Security tokens are regulated financial instruments, not just code on-chain. We make sure every legal requirement is covered, so you don’t have to learn it the hard way.

Every legal aspect

is covered before

you even ask

Skip 12-18 months of licensing wait

Security token offerings often stalls for over a year by regulation. Our legal umbrellas grant you immediate issuance rights.

Reach investors globally

Each region enforces its own token regulations. We partner with local experts to pre-clear offerings in your country. You can also scale easily after launch.

End-to-end compliance engine

Embedded KYC/KYB, AML/sanctions screening, document retention, and audit trails. All automated and vendor agnostic.

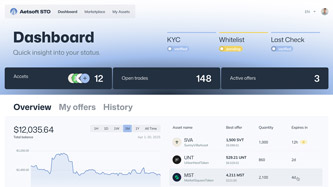

Secondary trading

Your tokens don’t have to sit idle. Trade freely on our built-in P2P platform or across licensed exchange partners.

$300+ million assets tokenized within our partner ecosystem

Full security tokenization cycle

under one roof

Overview

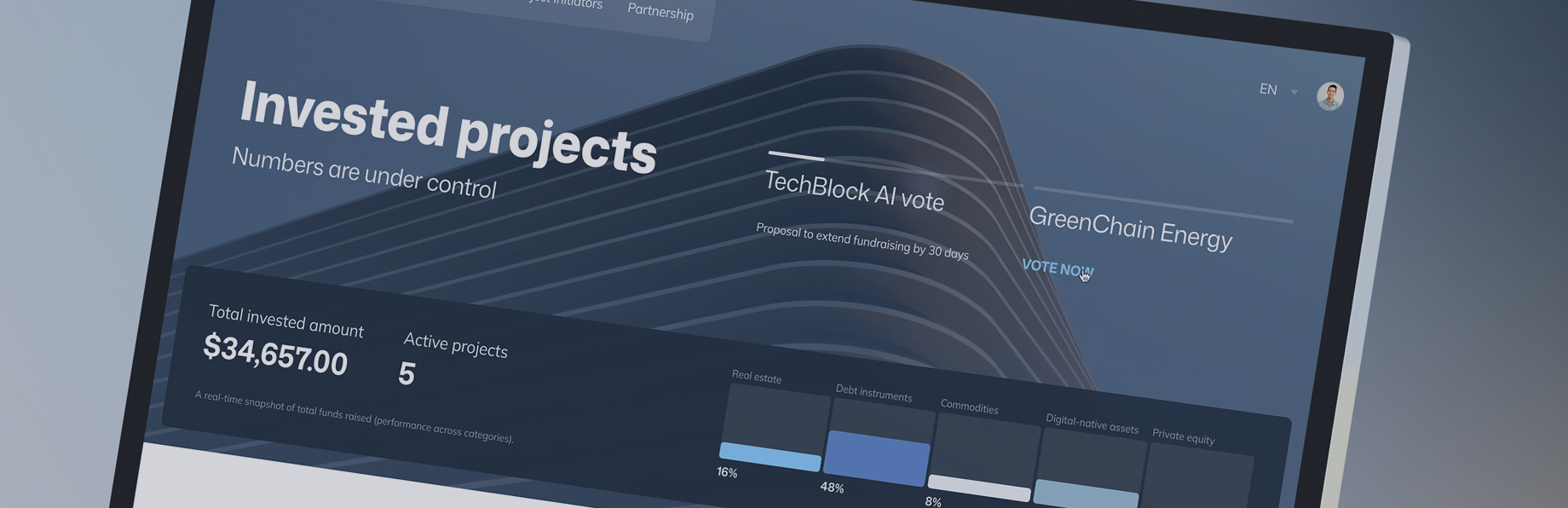

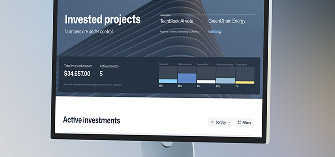

The fastest way to launch a compliant STO. Set terms, mint security tokens, onboard investors, and manage your cap table. All from one white-label platform.

No-code platform for security token offering, distribution & management

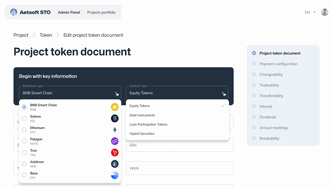

Multichain

Top public chains

Out-of-the-box connectivity to major public networks without manual configuration.

Adapt across networks

Switch chains or run on multiple simultaneously.

Customize your own chain

Get a private L1 or L2 chain tailored to your specs.

Benefits

One trusted partner for the entire STO journey. Aetsoft ecosystem connects the legal, compliance, and technical layers into a single workflow.

Get instant access to our STO ecosystem

Tokenize real world assets

Use cases

001

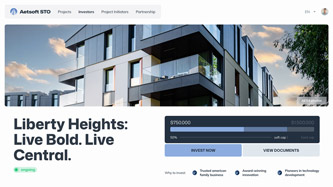

Real Estate

Fractionalize property investments, streamline ownership transfers, and enable 24/7 trading of real-estate tokens.

Use cases

002

Banks

Issue branded deposit and stablecoin tokens, loan-backed securities, and savings bonds. Complete with automated interest and payout schedules.

Use cases

003

Marketplaces

List, custody, and trade tokenized equities, debt instruments, or ETFs on compliant secondary markets.

Use cases

004

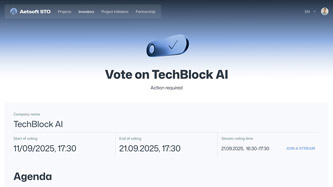

Web3

Launch compliance-grade tokens for DAOs, play-to-earn economies, and NFT-backed funds without sacrificing on security.

Use cases

005

Commodities

Tokenize natural resources, carbon credits, and energy assets; automate revenue sharing and track provenance on-chain.

Use cases

006

Venture Capital

Enable micro-investment in startups, tokenize fund shares for LPs, and simplify secondary trading of VC stakes.

Raise capital and digitize ownership under one roof

Issuance, compliance,

and investor management

Frequently asked questions

about our security token

offering platform

-

What is a Security Token Offering (STO)?

A Security Token Offering (STO) is a regulated way for businesses to raise capital using blockchain technology. Instead of traditional shares or bonds, companies issue digital tokens that represent equity, debt, or even real estate assets. Unlike ICOs, STO tokenization is tied to real assets and must follow financial regulations.

-

How does a security token platform work?

With an STO solution, a company turns its assets into digital security tokens and offers them to investors. Each token is tracked on blockchain for full transparency, while compliance checks like KYC/AML and investor accreditation ensure everything meets regulatory standards.

-

What makes Aetsoft STO Platform different?

Our white-label security token offering platform allows any type of asset tokenization (property, art, digital content, etc.) while users can raise capital through institutional-grade blockchain solutions. Besides individual digital assets, users can tokenize whole funds units and get unique benefits.

-

How do you launch an STO platform?

Launching a security token offering platform usually comes down to three parts:

- Legal setup — securing the right licenses and compliance framework

- Technology — setting up token issuance, smart contracts, and investor dashboards

- Operations — onboarding investors, managing payments, and enabling trading

Aetsoft manages the full tokenization cycle under one roof. We handle the technology and connect every legal and operational piece needed to bring your STO to target market.

-

What is a White Label Tokenization Platform?

It’s a ready-made platform that lets you issue, manage, and trade security tokens under your own brand. You get the full functionality without spending years building the technology or figuring out licensing and compliance.

-

Why choose a White Label Tokenization Platform?

Because it saves time, money, and headaches. Instead of developing from scratch, you can launch digital assets in weeks, operate under your own brand, and focus on investors. Licensing, compliance and infrastructure are already built in.

-

Can I integrate the platform into my tech stack?

Yes. Our STO platform connects easily to your existing tech stack through APIs and webhooks. You can embed dashboards, automate investor reporting, or sync data with your current asset management and payment systems. This ensures a seamless integration with your existing business workflows.

-

What are the main benefits of tokenizing digital assets?

Digital assets bring efficiency, transparency, and liquidity to traditional markets. Through asset tokenization, companies can reduce administrative costs, automate compliance, and enable fractional ownership using smart contracts built on blockchain technology. It’s a faster, more flexible way to manage and trade value globally.

-

Can I manage debt and equity tokens on one platform?

Absolutely. The white-label STO platform lets you issue and manage both equity tokens and debt tokens in a single interface. You can track investors, automate corporate actions, and process token distributions with built-in compliance features. This unified setup streamlines operations and helps ensure accuracy across all your tokenized securities.

-

Who are the ideal users of a white-label tokenization platform?

Our white-label tokenization platform is built for financial entities, fund managers, and companies launching real world assets or private equity offerings. It’s ideal for businesses looking to expand investment opportunities, introduce fractional ownership, and raise capital globally. All while operating under their own brand.